illinois payroll withholding calculator

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Paycheck Managers Paycheck Calculator is a free service available for anyone and no account is required for use.

What Is Local Income Tax Types States With Local Income Tax More

It can also be used to help fill steps 3 and 4 of a W-4 form.

. State W-4 Information General Paycheck Information. Our Illinois payroll calculator is designed to help any employer in the Land of Lincoln save time and get payroll done right. Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs.

Instead you fill out Steps 2 3 and 4. We have designed this free tool to let you compare your paycheck withholding between 2 dates. Exemption from Withholding.

Use Before 2020 if you are not sure. 1 2011 or have pre-existing creditable service with a reciprocal pension system prior to Jan. Revenue could be lost with a flat tax system depending on just how high that flat tax rate isFederal revenue totaled 152 trillion in the first four months of the fiscal year 2022 and more than two-thirds of that came from personal income taxes including taxes on capital gains dividends and interest.

Payroll taxes change all of the time. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line. Free Federal and Illinois Paycheck Withholding Calculator.

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. Automatic deductions and filings direct deposits W-2s and 1099s. Exempt from Tax Withholding.

Cons Explained. An employee may not earn enough each year to have to pay any income taxes at all. If you make 55000 a year living in the region of Florida USA you will be taxed 9076That means that your net pay will be 45925 per year or 3827 per month.

Switch to Illinois hourly calculator. Your average tax rate is 165 and your marginal tax rate is 297This marginal tax rate means that your immediate additional income will be taxed at this rate. Check if you are Non-Resident Alien.

Instead you fill out Steps 2 3 and 4. Paycheck Manager provides a FREE Payroll Tax Calculator with a no hassle policy. Calculate your paycheck withholdings for free.

W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020. Unlike your 1099 income be sure to input your gross wages. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator.

Tier 1 members in Teachers Retirement System of the State of Illinois first contributed to TRS before Jan. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line. Meaning your pay before taxes and other payroll deductions are taken out.

W-2 income. In 2020 an executive memo was released allowing employers to defer payroll taxes for employees. This box is optional but if you had W-2 earnings you can put them in here.

Unlike the Federal Income Tax Virginias state income tax does not provide couples filing jointly with expanded income tax brackets. Why Gusto Payroll and more Payroll. Free Federal and State Paycheck Withholding Calculator.

Users input their business payroll data including salary information state pay cycle marital status allowances and deductions. Private School Service Credit If you previously worked in a recognized private school you may be eligible to purchase up to 2 years of service credit. Lets say you have a job that pays 20 per hour but after taxes and retirement contributions your take-home pay is only 14 per hour.

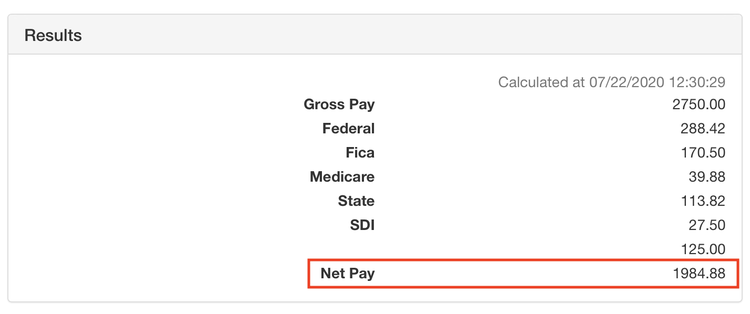

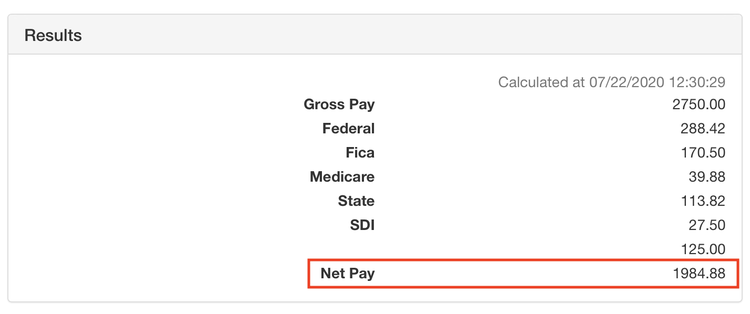

It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions. For Payroll in Tax Year. In order to avoid having any taxes withheld an employee may write the word Exempt on Line 7.

Employers who chose to defer deposits of their share of Social Security tax were required to pay 50 of the eligible deferred amount by December 31 2021 and the remaining amount by December 31 2022. This calculator is intended for use by US. If calculating payroll taxes ever starts to feel like a burden you might want to review our list of signs its.

Virginia collects a state income tax at a maximum marginal tax rate of spread across tax brackets. 2022 Federal and Illinois Payroll Withholding General Information. 2022 Federal State Local Payroll Withholding Calculator Canadian Withholding.

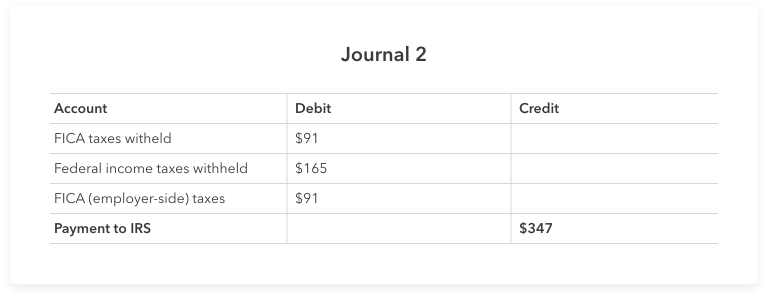

Taxes you deduct on behalf of your employees aka withholding taxes particularly to pay federal and state income tax. A 2020 or later W4 is required for all new employees. The Illinois bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Additionally IRS Notice 2020-65 allows employers to defer. Payroll check calculator is updated for payroll year 2022 and new W4. Virginias maximum marginal income tax rate is the 1st highest in the United States ranking directly below Virginias.

Use this payroll tax calculator to see how adding new employees will affect your payroll taxes. 800 732-8866 or 217 782-3336 Withholding Payroll.

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Illinois Paycheck Calculator Adp

How To Do Payroll Yourself For Your Small Business Gusto

A Small Business Guide To Doing Manual Payroll

Payroll Tax What It Is How To Calculate It Bench Accounting

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Tax Calculator For Wages Store 52 Off Www Ingeniovirtual Com

Tax Debt Help Bear De 19701 Tax Debt Debt Help Payroll Taxes

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Payroll Taxes Methods Examples More

Tax Calculator For Wages Store 52 Off Www Ingeniovirtual Com

Commercialista Milano Tax Accountant Accounting Money Savvy

Free Illinois Payroll Calculator 2022 Il Tax Rates Onpay

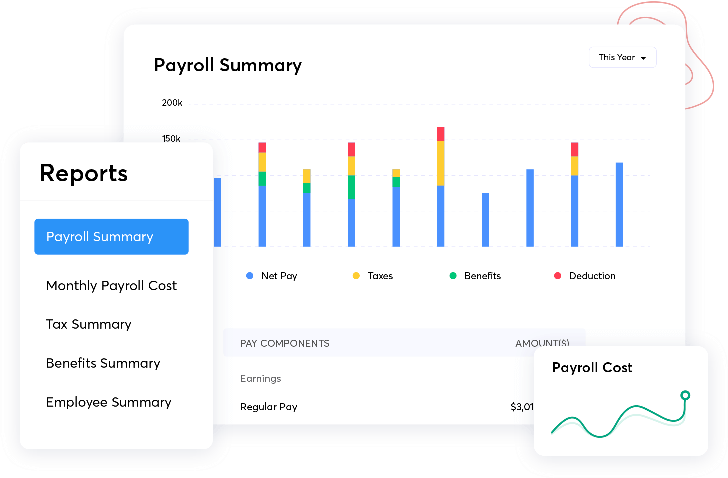

Online Payroll Software For Businesses Zoho Payroll

Premium Vector Income Statement Isometric 3d Concept Illustration 3d Concept Income Statement Isometric

What Is Payroll Accounting A Guide For Small Business Owners Article

How To Get An Accounting Job With No Experience Comptabilite D Entreprise Le Contrat De Travail Bourse

How To Calculate Payroll Taxes Methods Examples More

Tax Calculator For Wages Store 52 Off Www Ingeniovirtual Com